Credit Cards can let you fulfill your dream in a hassle-free manner. However, you have to abide by some of the essential rules.

Be it the credit limit or the fees associated with international usage, there are specific policies. Therefore, learn these conditions well while taking a credit card.

Are you traveling to a foreign country? In many countries, possessing a credit card while applying for a Visa is mandatory. The United Kingdom is undoubtedly one of them.

Today, you will get multiple credit card options to sponsor your foreign trip. However, they come with unique pros and cons. It is essential to identify the best credit card for foreign travel.

This content will provide you with knowledge about the top credit cards you can use for foreign travel. Stay tuned to get on a new adventure with the best credit card.

Discover The Adventures With Credit Cards

Get ready to experience brilliant foreign adventures with your credit card. Not only does it pay your bills, but also it lets you have great freedom in a new country.

Unlock new doors to embrace foreign adventures. Every credit card has lots of advantages attached. Therefore, you need to identify the most suitable criteria to acknowledge a card as the best one.

The benefits you can derive commonly from using a credit card for foreign travel are as follows:-

- Hefty discounts on flight tickets

- Low cash advance charges for international ATMs

- Low fee for foreign currency markup

- Access to international lounges

- Special rewards for transactions in a foreign country

Different types of cards are available in the UK, depending on their advantages and features. Your travel will be remarkable as you choose the best credit card for foreign travel.

The Best Credit Card For Foreign Travel

Here, I am enlisting the top 7 cards for a memorable foreign tour from the UK. The eight best credit cards for foreign travel are mentioned hereunder:-

1. Haliflix Clarity Credit Card

This special card does not involve any separate fees for using the card. Therefore, it does not matter whether you use it domestically or in a foreign country.

On the other hand, people always like to choose a credit card with a low APR for making purchases. Haliflix rates vary as per the nature of the transactions.

The best features of this card are:-

- 24/7 Customer Support from the UK

- Protection against frauds

- No transaction fees on cash withdrawals or other foreign transactions

2. NatWest Credit Card

NatWest Credit Card is another preferable card in the UK for foreign travel. Undoubtedly, it also does not charge anything as a card fee. Therefore, this is one of the cheaper cards available for multiple transactions in a new country.

However, a specific rate is attached, called the APR rate, for making foreign purchases. In the case of NatWest cards, it is 12.9% at present. It is subject to changes as per the country’s policies.

The salient features include:-

- No Annual fee

- No plans for instalment payments

- No fees on foreign transactions

- No fees for balance transfers

- Separate charges for cash withdrawals from foreign ATMs

3. Barclaycard Rewards Credit Card

You can consider this card to be the best credit card for foreign travel without any doubt. This is not because of a low APR but for its additional advantages.

Unlike many other credit cards, it offers a higher APR for purchases. Presently, the Barclaycard Rewards Credit Card has an APR of 27.9%.

However, you need not pay any fees to use the card in another country. Besides, other top features include:-

- No fees for cash withdrawals at foreign country ATMs

- Fee-free transactions in a foreign country

- Attractive cashback offers on spending (varies as per offers on different articles)

- Free Apple Subscription

- Special protection for purchases made above £100

4. Virgin Atlantic Reward Credit Card

This is another attractive credit card offering several exciting offers. Moreover, the cost of using the card in any foreign country is nil.

However, you must verify whether the destination country allows the usage of this card. The APR for purchases is 26.9%. This is not the ultimate rate as it keeps on changing from time to time.

Virgin Atlantic Reward Credit Card is subject to the following features:-

- No transaction fees for purchasing anything in EUR

- 15,000 bonus points for the first purchase using this card

- Earn 1.5 Virgin points for every £1 spent

- Special Virgin Atlantic and Holiday points on different spending

5. Bip Cardless Card

In the case of a Bip Cardless Card, you must not pay any card fees while using it in a foreign country. However, the APR is a bit high, now at 29.9%. Although it can be one reason to rethink taking this card, the advantages will surpass this small hurdle.

The top features of this card are:-

- Offers cardless credits, stored in your phone

- No foreign transaction fees

- No fees for cash withdrawals in a foreign country

- No Hidden fees

- Operative through mobile apps

- Easy tracking of finances and cash transactions

- Secured Spending cap

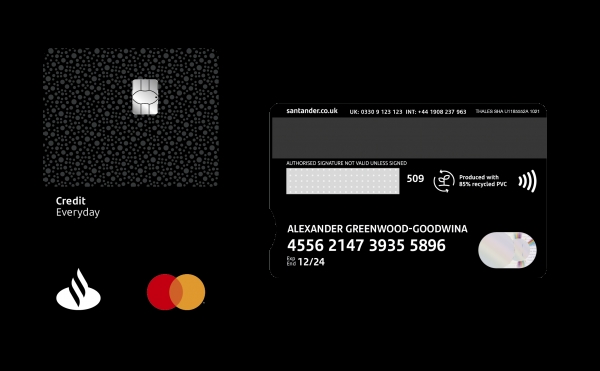

6. Santander All-in-One Credit Card

This card comes with a low APR of 21.9%. However, you need to pay £3 every month to use the card internationally. Besides, the interest rates will not bother you much.

The special features attached are:-

- Special Santander Boosts

- No fee for balance transfers

- Exciting cashback offers

- Attractive rewards for every £1 spent on different transactions

- No annual fees

- 0% interest for 15 consecutive months on purchases

- No foreign transaction fees

7. Zopa Credit Card

This is also a highlighting card among the best credit cards for foreign travel. It offers hassle-free transactions in most countries outside the UK. The APR rates start from 24.9% depending on the type of transactions you do.

The other features are:-

- Availability of instant notifications

- No fees for foreign transactions

- Offer of Credit Cushion

These are only a few of the credit cards popular in the UK. However, apart from them, you may also use other credit cards. The key factor for selecting a credit card is its maximum benefits.

Understand the features well before investing in it. Know the due dates of payment and the payment pattern to avoid any disputes.

Conclusion

While selecting the best credit card for foreign travel, you must consider some important features. Furthermore, many types of cards provide multiple benefits for UK cardholders. Therefore, you must know the APR rates and the fees and charges attached to the cards.

Some features a favourable credit card for foreign travel must have are:-

– No cash withdrawal fees

– No foreign transaction fees

– Bonuses and additional rewards

– No upfront fees or balance transfer fees

– Favourable exchange rate

Check out the best credit card options in the UK and plan your foreign tour. Of course, your trip will be more enjoyable when your credit card is there to support you. Get UK customer support help for the top cards.

FAQs

Which form of credit card is mostly accepted in the UK?

Usually, people in the UK like to use Visa and Mastercards to make most of their credit purchases. They are equally effective domestically and internationally.

Is there any absolute limit for credit cards in the UK, for foreign transactions?

A standard credit card in the UK gives you a credit limit of £5000. You have to follow the rules for foreign transactions also.

Can my credit card give any benefit on foreign exchange rates?

Yes. Several credit cards like Wise, Santander, NatWest, Travelex Money Card, etc. offer the best foreign exchange rates.