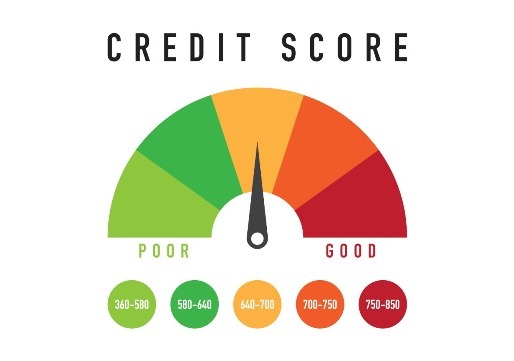

Having Credit Cards for Bad Credit can make it challenging in the UK. A credit score is one of the essential things necessary for getting a credit card.

However, there are strategies and options available to ensure approval, even with bad credit.

In this guide, we’ll explore what bad credit means, why it’s essential to understand credit scores, and how to secure approval for credit cards despite having a less-than-perfect credit history.

Understanding Bad Credit and its Impact

Bad credit refers to a low credit score resulting from past financial missteps, such as missed payments, defaults, or bankruptcy.

It can significantly limit one’s ability to qualify for credit cards, loans, or mortgages. Bad credit can also lead to higher interest rates and less favourable terms when approved for financial products.

Credit cards for bad credit with guaranteed approval

People who are irregular in paying their credit card bills will have bad credit.

There are three kinds of credit reference agencies available in the UK that help people find their credit score with their previous financial status and credit card billing history.

Some of the best and guaranteed approval credit cards are

- Tesco Bank Foundation credit card

- Vanquis Bank Chrome Credit card

- NewDay Ltd Amazon Classic Mastercard

- HSBC classic credit card Visa

These are some of the credit cards available for all people with low credit scores, and they also have various features similar to the other credit cards with slight changes.

So, people with low credit scores and people who need to rebuild their credit scores can choose one card from this list of available credit cards in the UK.

These are some facts about credit cards for people with bad credit with guaranteed approval.

What is the eligibility to get a credit card?

With most credit card providers, people above 18 are eligible to get credit cards, and with some providers, the eligibility age is about 21 years.

Along with that, people who apply for a credit card in the UK should have their mailing address. And people should be employees with a certain amount of income, or they should be students in college or university in the UK.

People with a payment or assert to pay the minimum or the lowest monthly pay are eligible to get credit cards from the providers.

Along with these eligibilities, people should also have a perfect credit score which is the primary element necessary to get a credit card.

And though there are different kinds of credit reference agencies available in the UK, a good credit score is about 811 to 961, and a bad credit score is between 438 to 560.

So, these are some facts that people need to know about the eligibility criteria for getting a credit card in the UK.

What is considered a bad credit score in the UK?

As given above, the credit score is the essential element to getting a credit card. There are several credit card providers available in The UK.

This county follows some rules in the country: people with low credit scores can’t get credit cards from regular credit card providers. And the bad credit score range is about 438 to 560.

Experian, TransUnion, and Equifax are the three credit reference agencies in the UK, so each agency’s bad credit score range will differ.

Though there are these rules, some providers provide credit cards for bad credit UK, and those credit cards will have features different from the standard credit cards.

Which credit card I can get easily?

Though many providers refuse to provide credit cards for people with low or bad credit scores, Some providers are willing to provide guaranteed approval for those with bad credit scores.

The Tesco Bank Foundation credit card is one of the best choices for people with bad credit scores to get a credit card. This credit card will have various limitations and regulations different from regular credit cards.

To get these kinds of credit cards, people don’t need to have a high credit score, but all other eligibility criteria of the regular credit card will apply.

Improving Your Approval Odds

If getting a new credit card is important for building or rebuilding credit, here are some tips that can help improve your chances of approval when you have poor credit:

- Check Your Credit Reports – Verify that the negative information being reported is accurate and have any errors are corrected before applying.

- Include Steady Income – Having enough verifiable income to make monthly payments is essential. You may need to document your income sources.

- Manage Debt Levels – Paying down existing debts can help lower your credit utilization ratio, which is a factor issuers consider.

- Apply for Secured Cards – These require an upfront refundable security deposit to reduce risk for the issuer. Upgrade potential once payments are made on time.

- Become an Authorized User – Getting added to another person’s long-standing, positive credit card account could provide a scoring boost.

- Check Pre-Approval Tools – Some issuers allow you to get pre-approved or check the likelihood of approval before formally applying, which prevents a hard credit inquiry.

What kind of credit card can customers get with a bad credit history?

People will get credit cards similar to regular credit cards, but they will have different features and capabilities than regular ones.

There are various credit cards available for people with low credit scores. And these credit cards will help people rebuild their credit scores with multiple elements that help people increase their credit value.

These are some points people need to know about getting credit cards for bad credit UK.

People with these bad credit scores don’t need to worry because there are many ways available for people to increase their credit scores.

Can I get a credit card with really bad credit?

Yes, getting a credit card with a horrible credit score is possible. Still, it is not possible with all kinds of credit card providers.

Only a few credit card providers provide credit-building cards with different features than the original credit cards available for people with good credit scores.

So, people with bad credit scores don’t need to worry about it because people can change their credit score through various methods and credit-building cards are among the plans.

These are some common facts that people need to know about the possibility of getting credit cards with terrible credit scores.

Conclusion

If people need to get a credit card with a bad credit score, many credit-building card companies provide credit cards for people with bad and low credit scores.

These are some of the points about getting credit cards for bad credit in the UK. Even though these credit cards are available for people with low credit, other eligibility criteria are similar to the regular credit cards public in the UK.

Credit card debt can be a really difficult issue to deal with. It can be tempting to use your cards to make purchases that you can’t afford to pay back right away, but you need to be careful not to get too far behind.

If you can’t pay your credit card bills on time, you may be subject to interest charges and other penalties. It can be tough to get out of debt, but it’s important to remember that there are a lot of resources available to help you.

If you’re struggling to manage your credit card debts, consider talking to a financial counsellor about your options.

Which is the easiest credit card to get in the UK?

Ans- Aqua Credit Card, Vanquis Credit Card, Capital One, The Easy Loans Credit Card, etc. are the easiest credit cards to get in the UK.