Are you planning a long-awaited vacation this year? There are a variety of best cards to use abroad intended expressly for use while travelling that can help you avoid unexpected costs when you arrive.

These transactions may come and go with the market, and their conditions might vary. However, when overseas vacations returned to the menu, we researched to locate some of the best prices. The ones we discovered are listed below.

However, it is essential to note that not all applicants will be eligible for these cards. Your circumstances, such as your credit history and salary, will determine your ideal travel credit card.

However, you may always utilise an eligibility checker to determine your odds of acceptance. You have nothing to lose since this will not affect your credit score.

What Are Traveling Cards?

If you use a debit or credit card to make a purchase or withdraw cash in a currency other than pounds sterling, your bank will charge you a fee to convert the amount you spent into pounds sterling.

The amount that will cost you will be determined by two factors: the exchange rate established for your card by the payment network (Mastercard, Visa, or American Express) and the fees your supplier adds on.

These costs are not included with specialist travel credit cards, which makes it considerably more affordable to spend money overseas or on foreign websites in a different currency.

How Do Traveling Cards Work?

The majority of credit cards and debit cards allow you to spend money overseas, but they will often charge you a fee for the privilege. Even if your card issuer has access to almost flawless exchange rates, it will almost always tack on a “non-sterling transaction charge” of roughly 3%. This means purchasing £100 worth of foreign currency will earn you back £103.

In addition, most debit cards assess a fixed fee—typically ranging from fifty pence to one and a half pounds—every time you purchase abroad, regardless of the amount. Using a credit card to withdraw cash often results in fees and interest charges that cannot be avoided.

There is the best card to use abroad that does not impose these costs; thus, you are provided with an exchange rate almost identical to the one provided by the bank when it processes your transaction. Because this often occurs a few days after using the card, you will need to know the actual rate you’re receiving at the moment you use it.

Consider getting prepaid credit cards to use abroad with a rate that can be locked in if you are concerned about fluctuations in the value of the currency you will be using.

5 Best Cards to Use Abroad When Travelling Outside of the UK

#1. Halifax Clarity

According to Fairer Finance, persons with a lower credit score are more likely to be approved than those with a higher credit score for Barclaycard Rewards. This is the best credit card for travel as there are no foreign-use fees when withdrawing foreign money from an ATM or paying for products or services like a restaurant bill.

The card has a reasonable APR ranging from 22.9% to 28.9%, depending on your credit score. It utilises a Mastercard exchange rate, while Barclaycard uses Visa. There is virtually little difference between the two, with both approaching the ideal pace.

#2. Zopa

Image source: THE TELEGRAPH

Zopa is well known for being the first peer-to-peer lender in the United Kingdom; however, the company also provides the best credit card to use abroad. It does not charge additional costs for using it in other countries, and it also provides a handy option that enables you to save money aside in case of an unexpected need while you are away.

Depending on your credit rating, you may first be issued a credit limit between £200 and £2,000. There is a wide range of possible annual percentage rates, starting at an above-average 24.9% and going up to 34.9%.

In our ratings, the card receives a score of three stars. The most significant drawback is the flat cost of £3 that is charged for domestic and international cash withdrawals.

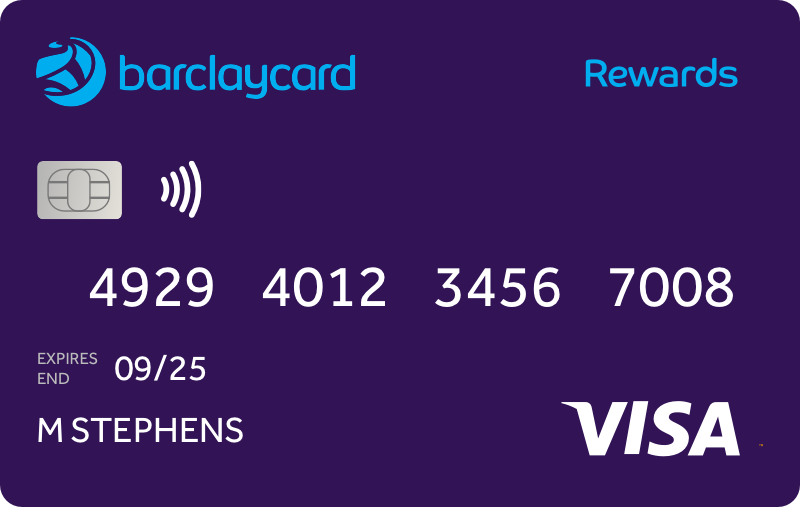

#3. Barclaycard

Image source: USWITCH.COM

It’s the best credit card for travel, eliminating the need to cut and replace your cards depending on where you are. If you travel overseas, you may withdraw cash from an ATM or purchase souvenirs without paying fees.

It does not impose interest on foreign purchases or cash withdrawals as long as the amount is repaid monthly. It also provides a modest 0.25% cashback on spending, which, although not the greatest on the market, is still enough when combined with the other incentives. The card reaches with no annual fee.

#4. Chase’s current account

Digital bank, an app-based current account offered by Chase, does not impose any fees for purchasing in other countries. Up to a limit of 1,500 pounds sterling per calendar month, cash withdrawals made in other countries are free of charge.

When you apply, Chase will do what is known as a “soft” credit check, which will not impact your credit score, unlike an application for a credit card.

This account provides 1% cash back for a whole year on most purchases made anywhere in the globe; however, you will first need to activate this feature inside the app.

Additionally, Chase’s easy-access savings account gives a rate of interest of 2.1%, although the interest rate offered by another savings provider may be higher.

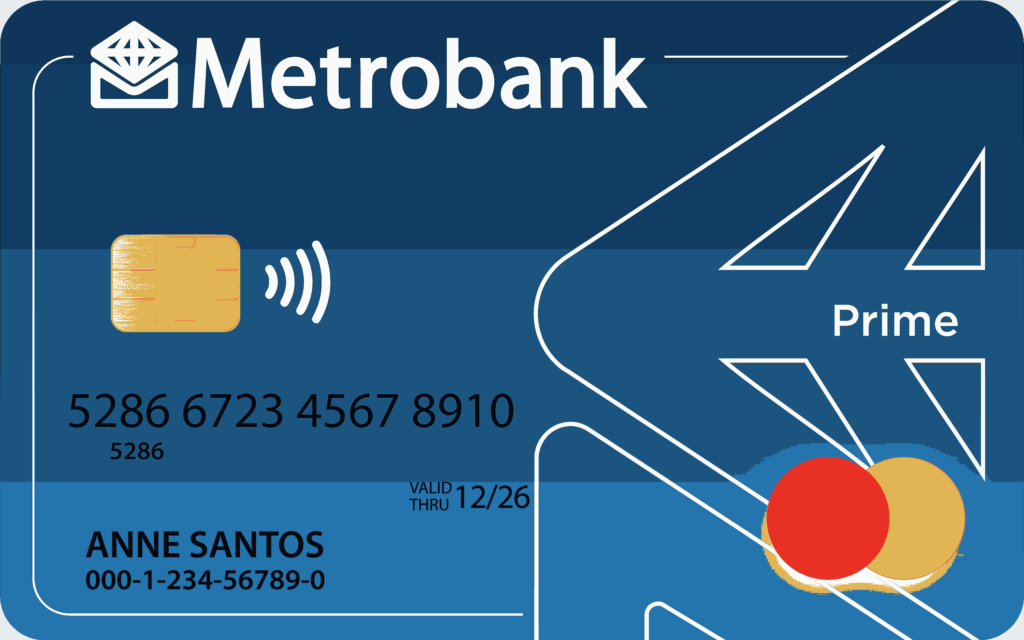

#5. Metro Bank Credit Card

Another one of our independent assessments gives this best debit card to use abroad a perfect score of five stars. Although it has the lowest cost of borrowing out of our top five options, you must be sure to pay off the whole sum each month to prevent paying interest.

It features a single, straightforward, competitive representative APR of 14.9% and does not impose an annual fee. When the card is used in Europe, there are no fees assessed for its usage in a foreign country.

Be aware that you will be set a fee of 2.99% for any withdrawals or spending that takes place outside the continent.

Can I use my debit card internationally?

Despite being very helpful for making day-to-day purchases and banking transactions, traditional debit cards are often unable to be used in countries other than those in which they were issued.

Because Visa and MasterCard are the two most prominent international debit card issuers, these cards are accepted in a variety of nations throughout the world.

Travelling with Cards: Some Rules to Follow

Make sure to abide by these unbreakable restrictions if you want to use the best credit card for travel on your next tour.

Avoid cash withdrawals

Even if you have a card that doesn’t impose a fee for foreign ATM withdrawals, you may still want to refrain from withdrawing cash. This is because interest is often charged immediately and sometimes at a higher rate.

These fees may be avoided if you’re organised and pay off your credit card as soon as possible. However, you could choose to stay away from this inconvenience. If you use your credit card to withdraw money from ATMs, you might damage your credit score.

Make purchases using local currencies.

Choose the local currency whenever possible if you have a top abroad credit card since your card offers the most excellent conversion rates.

If there is no 0% period, don’t borrow.

Unless you can get a card with a 0% purchase term, you should try paying off what you owe monthly to prevent interest from accruing.

Why Use Travelling Cards?

When you are on vacation in another country, using plastic to pay for things is a convenient alternative since it relieves you of the burden of carrying cash and the mental challenge of converting currencies.

However, you may be subject to additional costs if you use your usual credit cards while away for the holidays.

Most credit and debit cards impose a fee for transactions made in a currency other than sterling. This is generally at around 2.99%, which means that for every £100 you spend, you will be charged an additional £2.99. When you use your card in a country not part of the European Union, you may be subject to an extra cost from certain card issuers.

When you use your credit card to withdraw cash from an ATM, the transaction will cost you a lot of money. Even if you pay off the debt in total during the same month, you will still be subject to an instant interest charge and a withdrawal fee (which might be a percentage or a set sum).

There is a good chance that debit card withdrawal fees will also apply to you.

To summarise, even if you make a handful of transactions, the costs may quickly add up to a significant amount. The costs associated with these purchases may be avoided entirely or partly by using a credit card explicitly intended for travel expenses.

FAQ-

Is it cheaper to use a debit card or cash abroad?

A prepaid travel card can be your best option if you’re trying to stay within your spending limit without running the danger of carrying cash. These function similarly to debit cards in that you may use them to withdraw cash or pay for products and services at the register.

How can I avoid debit card fees abroad?

Using a debit or credit card that doesn’t charge foreign transaction fees when going overseas is the simplest method to avoid paying one. Fortunately, several credit and debit card alternatives benefit international travellers.

Which debit cards are free for abroad?

No costs are associated with using the Halifax Clarity card to make purchases or cash withdrawals overseas. However, it is only free if you pay off your amount in full. If you allow a debt to roll over from one month to the next, you will be charged interest at a rate of 22.9% APR (variable).

Which Is better to use, a credit or debit card when abroad?

A credit card is recommended for use while travelling abroad since. If it is lost or stolen, you can access your actual money.

What is the best way to pay for things abroad?

To minimise costs, receive the best exchange rate, be protected, and yet have cash accessible for minor transactions, a combination of a speciality credit card, prepaid card, and cash is the ideal solution.

Conclusion

Some of the most common benefits of the best card to use abroad include airport lounge access, travel rewards, air mile earnings, and partner benefits. With these travel cards, you may accumulate various travel discounts, points, and cashback. You must choose depending on your requirements given the many possibilities available.

If you often travel, getting a credit card that offers lounge access or searching for cards with flexible feature choices is preferable. Additionally, you may contrast cards depending on the yearly price and welcome bonus.