As the United Kingdom redraws the future relationship with the European Union (EU), recognizing where to invest in the UK stock market after Brexit is difficult for every investor. The hedge fund manager, everyday investors, and traders, pension fund managers will remember the large moves that developed in the UK stock market after the referendum result, in 2016.

In this article, we will discuss the impact of Brexit on the UK economy, the UK stock market after Brexit, and the impact of Brexit on the UK stock market.

The impact of Brexit on the UK economy:

As the UK pulled out of the single market and customs union in 2021, the companies trading with the EU faced new regulations, new paperwork, and new checks on some goods.

When Britain left the European Union on 31 January 2020, Prime Minister, Boris Johnson, proclaimed that “Britain would rediscover the muscles that we have not used for decades”.

There years after a rupture in the economic ties with Europe, the country has the lowest growth rate among the G7 countries and the IMF forecasts that it will be the only economy that will shrink this year.

But, Brexit is not the only reason behind Britain’s economic underperformance, it is an important factor to consider.

Here are some factors that will discuss what Brexit has meant for the British economy to date.

1. The Brexit hit to trade has been significant, and many have occurred more quickly than previously assumed:

Britain’s economy has been hit significantly by its move from the single market. Trade in goods with the EU dropped sharply after the Brexit transition period ended, with UK imports from the EU falling by approximately 25 per cent more than UK imports from the rest of the world. This trend persisted throughout 2021.

This analysis is consistent with the other studies that show the short-term shortfall in imports after leaving the EU has ranged between 14 to 25 per cent; with that of exports around 6 per cent.

2. Britain’s trade openness has fallen more than has been seen in other comparable economics since Brexit:

The UK economy is now less open for trading than before Brexit. Trade openness is measured as the ratio of trade relative to gross domestic product. It has fallen by 8 percentage points between 2019 to 2021. It was driven by a sharp fall in trade with the EU.

The reason behind the drop in the UK economy suggests that Brexit is the main driver of Britain’s underperformance.

3. The red tape faced by Britain businesses is at a record high:

Higher costs of trade can be seen not only in the total data but also in the paperwork followed by the British businesses following Brexit.

Customer-export declarations that businesses must fill in when moving goods from the UK leaving the single market and customs union. Further, import declarations have increased by 50 per cent during this time. This is an unprecedented increase in the red tape facing businesses.

This raise cost the trade-also disadvantaging the smaller firms because they can’t absorb the extra costs.

The UK stock market after Brexit:

Since the UK people voted to leave the EU in the 2016 referendum since then UK equities have significantly underperformed every year. The Covid-19 pandemic in early 2020 made matters worse and also pushed the UK economy into the worst recession in over 300 years.

This fuelled an emigration of institutional money from UK assets into markets offering better yields such as US equities in the technology sector.

But, the depressed assets price have made UK equities one of the cheapest stock markets in the past few years. This is only the reason investors are keen to understand the effect of Brexit on the UK stock market in more detail. However, the long-term opportunities can prove to be quite interesting.

While independent investors can use the multi-year decline in the UK stock prices for trying to find the value stocks, professional traders at the same time attempt to hedge their exposure.

There are a variety of ways to hedge your portfolio from falling stock prices. One way is for independent investors to use Contracts for Difference that allow the traders or investors to potentially profit from falling stock prices. As well as rising markets.

The impact of Brexit on the UK stock market: proof from FTSE 100:

Many investors were caught off guard after the Brexit referendum because the UK stock market surged higher after the vote, as you can see in the yellow box on the monthly price chart of the FTSE 100 index box:

To better understand the phenomenon and the potential Brexit stock market impact on the future economy, you must first learn the uniqueness of how the UK stock market is built.

Various firms listed in the FTSE 100 make a large portion of their profits in US Dollars. So, the movement of the British Pound has a significant role in the UK stock market.

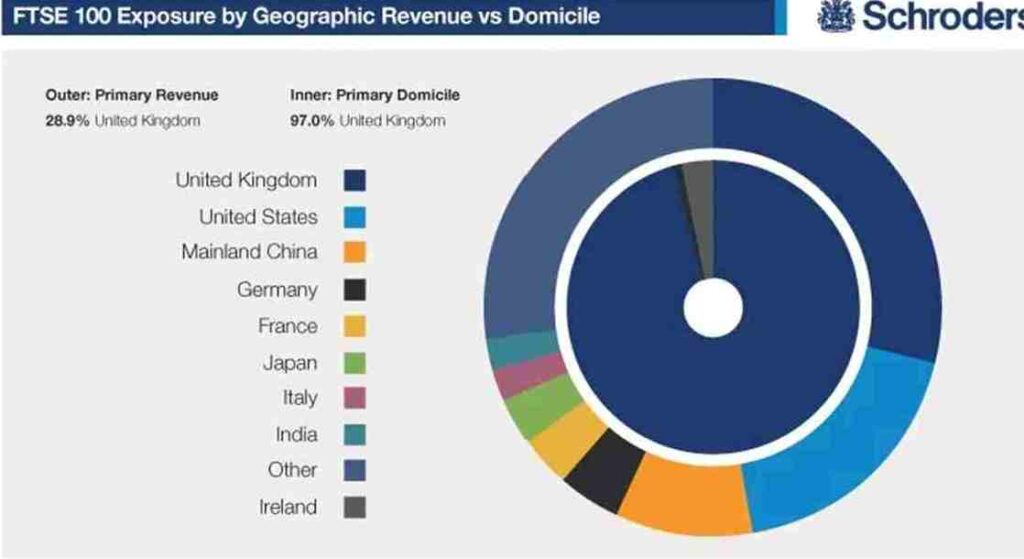

In the following chart by the asset Management Company Schroders, the innermost circle shows that 97% of companies in the FTSE 100 have their head office in the UK. But only 28.9% of the total revenue generated comes from the UK.

Image Source: Schroders

So you can imagine a scenario where the GBPUSD exchange rate was trading at 1.5000. This means that every $1,000 in revenue would be £666. If the British Pound weekend and the Exchange rate fell to 1.2000 this means that the same $ 1,000 of revenue now be worth £833.

While a falling sterling can benefit some companies in the FTSE 100 it can also hurt others. The company’s business model makes a huge difference in whether it will be impacted by Brexit or not. If we need to answer what is happening in the British stock market then the answer lies in the British Pound.

- A country’s currency will rise if the investors are positive about its economic prospects of it. This is because the Central bank increases interest rates during an economic boom to make sure inflation does not get too high. So, large asset managers will buy bonds in the currency of that country to get access to these higher interest rates.

- Yes, if a country’s economic prospects are not so good or uncertain then the investors will take out their money to invest in another country in search of higher yields. This will lead to a higher fall of the country’s currency and that is what happened before, during as well as after the Brexit referendum.

FAQs-

What are the challenges faced by investors due to Brexit?

Ans: The investors need to face various challenges because of the Brexit referendum. One of such challenges is losing the free trade benefit that means cross-border customs check and tariffs. Trading is involved far more paperwork and delays, potentially pushing up prices and corroding competitive advantage.

Which sectors were most impacted by Brexit?

Ans: The automotive, pharmaceutical, airline, and financial services industries were most impacted by the Brexit referendum. Industries across the UK were not prepared for Brexit, so following the ‘leave’ result, the industries were forced to replan their upcoming strategies to avoid a sudden drop in revenue.

Conclusion:

When the UK and the EU announced their trade agreement, officials, private citizens, and business leaders both were relieved. Brexit likely throws more challenges on the UK economy than the EU. The Pound rose on the UK market by approximately 0.47% against the US Dollar and 0.46% against the Japanese Yen.

Various sectors are mostly impacted by the Brexit referendum and some of the sectors were likely to be less affected by Brexit. So, you need to find out the right investment portfolio for you so that you can view the price chart and invest in the stock market in the UK.