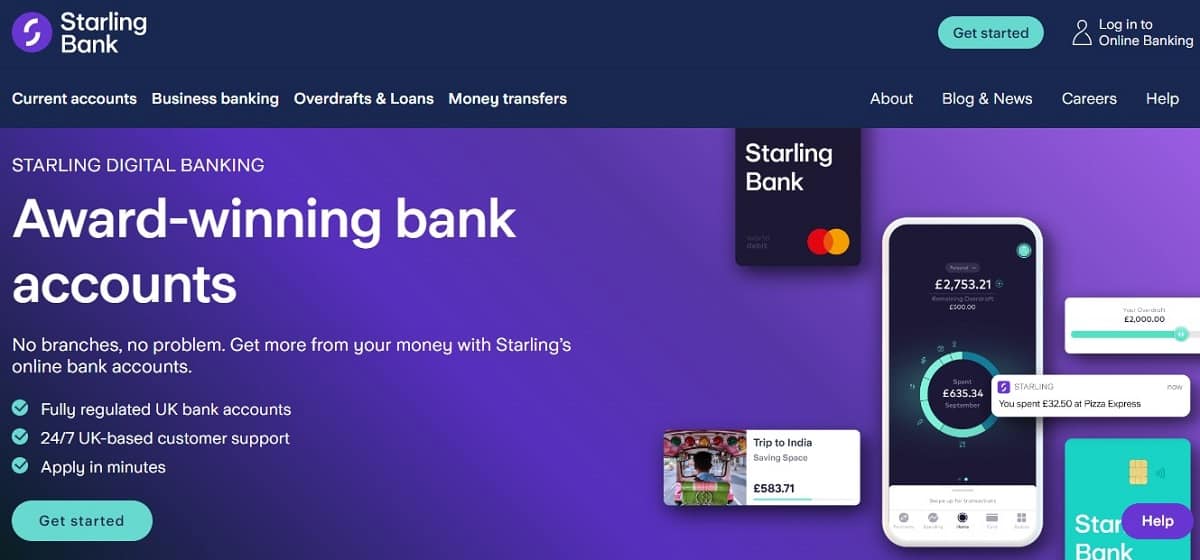

Starling Bank is a bank that has won several accolades and is thoroughly licensed. It was created to provide customers with an option that is more just, intelligent, and human than traditional banking institutions.

There are five distinct account types available to customers of Starling Bank: personal, business, joint, euro, and a kid card. Combining this with a ground-breaking payment services proposal for commercial clients.

The cutting-edge technology used by Starling reconceives what it means to do banking in modern life. They provide the resources that individuals need to have a positive relationship with their financial situation in the palm of their hand. Let us look at Complete information on Starling Bank accounts and services.

Banking Service

A banking service can be defined as a system that provides an individual or business with access to funds and other financial products. In recent years, banking services have become increasingly digital, making it easier for customers to bank from their homes or offices.

There are a number of different types of banking services available, including traditional banking products such as loans, mortgages, and banking services for small businesses. Online banking services allow customers to conduct their banking transactions from their computers or mobile devices.

Banking services can be a valuable resource for individuals and businesses. Banks offer a range of products and services that can help customers save money and improve their financial stability.

Key Features of Starling Bank-

Put a hold on your card – if your card is lost or stolen, you can hold this on the app. Establish a plan for your savings, and earn interest on your money as you put it toward your objectives.

Set up savings goals – Make payments from your savings accounts; to prevent misunderstandings about your available funds, set up automatic payments from your savings accounts for all direct debits and standing orders.

Nearby payments – Send payments privately to other Starling users that are nearby using the Nearby Payments feature.

Expenditure tracking by category – Have your transactions automatically categorized into the appropriate category.

Adjust your contactless spending cap – You can decide how much you can spend on contactless transactions.

Free ATM withdrawals in other countries – (some cash machines charge their fee)

International money transfers – Transferring money on a global scale is also possible using this app, which may be used to make international transactions. This is a far more affordable alternative than international money transfers offered by many banks, which may cost up to 5 percent.

Mobile check deposits – Deposit cheques up to £500 from your mobile phone

Log in through desktop – Users can log in using a desktop, whether a PC, a laptop, or a Mac.

Starling Bank Account types

Starling Bank personal accounts

To create a Starling Bank personal account, you don’t have or arrange an appointment over the phone to go into a branch; instead, all you have to do is download the app onto your smartphone and follow the on-screen instructions.

To open a personal or joint account with Starling Bank, you need to be at least 16 years old and a resident of the United Kingdom. The application must be downloaded into a smartphone. The applicants must provide a government-issued picture identification card, such as a UK passport or driver’s license.

Starling estimates that this procedure will take around five minutes, much less than it would take to visit a bank office during regular business hours physically. There is also a specific account for 16- to 17-year-olds interested in learning how to handle their money.

Starling Connected Card

Starling Connected Card enables you to delegate the spending of your funds to a trusted third party. It is easier to avoid the headache of transferring money or dividing a payment when using the card, which is meant to be provided to trusted friends, family members, and caregivers.

The maximum amount that may be loaded onto the card is £200. However, the funds are stored in a distinct space inside the Starling app and are, as a result, kept separate from the funds in your primary account.

Starling Kite account

Starling Bank has introduced a savings account for children between 6 and 16. However, the parent or guardian must establish a personal or joint account with the bank to open one. The Starling Bank Savings Account is a “Space” inside the adult account.

Because it is housed inside a personal Starling account, it is simple to establish recurring payments and instantaneously send money into a Starling Kite account. A Starling Kite account may be opened for only £2 per month per card, and there are no extra fees associated with sending or withdrawing money from the account.

Starling Bank Business accounts

Starling Bank Business accounts are pretty similar to the personal account it offers. According to Starling Bank, the application process for its business account takes approximately 10 minutes longer than the one for a personal account.

However, in comparison, most banks will require you to make an appointment and wait in a branch for a couple of hours to get approval for a business account. Instead, you will need to download the app, provide your personal information and information about your company, and authenticate your identity by sending a video and identification papers.

However, given that the bank can have additional questions, opening this kind of account might take somewhat longer than opening a personal one.

Starling Bank Euro accounts

Anyone with a personal or business account at Starling Bank can open a Starling Bank Euro account. With this account, people can hold, send, and receive money in both pounds and euros.

Fees in Starling Bank

If you already have a personal Starling account, you may establish a free euro account in addition to that account at any time. However, a modification to the interest rate applied to some high-value euro accounts became effective in November 2020. Any sum above €50,000 is subject to a negative interest rate of 0.5 percent, indicating that account holders with a balance over that level will effectively be taxed 0.5 percent for holding that part of their money on deposit.

Starling charges reasonable fees.

Current account and transactions

You won’t incur fees while using Starling for standard banking activities and transactions. There is no charge for using the card to make payments or withdraw cash from an ATM, regardless of whether you are in the United Kingdom or another country.

International money transfers

When you send money overseas with Starling, you will be subject to a fee that varies according to the recipient’s nation and the total amount sent.

Cash loads

Customers with personal checking accounts at your neighborhood Post Office may make free cash deposits and withdrawals, and vice versa.

Is it Safe to use Starling Savings Accounts?

When choosing a bank, one of the most important questions you should ask yourself is whether or not your money will be secure. Who is going to assist?

Starling Bank’s leadership has previous experience working for other reputable financial organizations, and the bank is authorized to do business by the Prudential Regulation Authority.

The Financial Services Compensation Scheme protects it (FSCS), which means that the government will guarantee the safety of your money (up to £85,000) if the bank goes bankrupt, which is the most significant aspect to consider.

When you sign up with Starling, you are not required to use it as your sole bank account. Therefore, if you are interested in using its services but are not yet prepared to make a long-term commitment, you need to move some money into a brand new account and give it a try.

How is Starling Bank Customer Service?

Customer service refers to the assistance made available to clients when they use a company’s goods or services. Customers may perform transactions, such as deposits and withdrawals of money, as well as apply for loans with the assistance of bank tellers and customer support personnel.

Starling Bank provides high-caliber customer service since doing so makes clients feel appreciated. It enables better satisfaction of client requirements and increases the number of long-term clients retained overall.

Can I use the Starling Bank card, Abroad?

Yes, you can use your Starling debit card abroad should be a far less complicated experience than using a typical bank card.

Starling is a mobile app; managing your finances while you’re out and about is much less complicated than before. Because using your Starling Bank card internationally does not result in any additional costs. You won’t be subject to any additional charges while making purchases overseas or withdrawing cash from an ATM.

When you purchase a currency other than Starling, the transaction will be processed using the exchange rate that applies to Mastercard transactions. In addition, Starling won’t charge you any fees if you take money out of an ATM in a country outside of the United States.

Pros and Cons of Starling Bank

Pros of Starling Bank

- Quick and straightforward to put together

- 24/7 access

- Alerts on spending as well as a classification system

- Spending without fees in foreign countries

- There is no charge for the services every month.

- Desktop version for customers who desire to conduct their banking activities using a PC, Mac, or laptop

- Free from danger and risk

Cons of Starling Bank

- Since the Marketplace only provides discounts for businesses that Starling collaborates with, the prices may not be the most competitive.

- You must be a resident of the United Kingdom to establish an account.

Starling Bank alternatives

Challenger banks do not yet provide a comprehensive selection of services; nonetheless, they often provide fee-free digital-only current accounts that may be created in minutes.

These accounts can readily serve as current primary accounts so long as the customer’s banking requirements are straightforward. You can anticipate a free current account, card, and app with any of them, as well as free card payments and bank transfers inside the UK while using any of them.

If you exclude Starling from consideration, your primary choices are as follows:

Monzo

Monzo, the most popular challenger bank in the UK, has two million users and is perhaps comparable to Starling, ticking most of the conditions. You may also deposit cash into your account at PayPoint for £1 for each transaction. It’s the only one that offers overdrafts (up to £20 for free, then 50p per day after that).

Revolut

Regarding some fundamental day-to-day banking, Revolut was designed more as a multi-currency card than a bank account, and it shows. In the UK, you can’t currently set up direct debits, and the amount of free cash withdrawals is just £200 per month.

Monese

Another alternative is Monese, which has been offering fundamental banking on cell phones since 2015. The unique feature of Monese is the freedom to create an account anywhere in the UK or Europe without a physical address, a credit history, or a steady source of income.

Conclusion:

Starling Bank has created a bank for the twenty-first century that you may use anytime you want without needing to go to a bank location. It also contributes to the savings culture by encouraging users to preserve their spare change and exposing individuals to new financial services.

On the other hand, unlike the central street bank, it is open 24 hours a day. Overall, it’s hardly a surprise that Starling Bank has received so many accolades. If you want to know the Starling Bank account, above we briefly discussed Complete information on Starling Bank accounts and services.