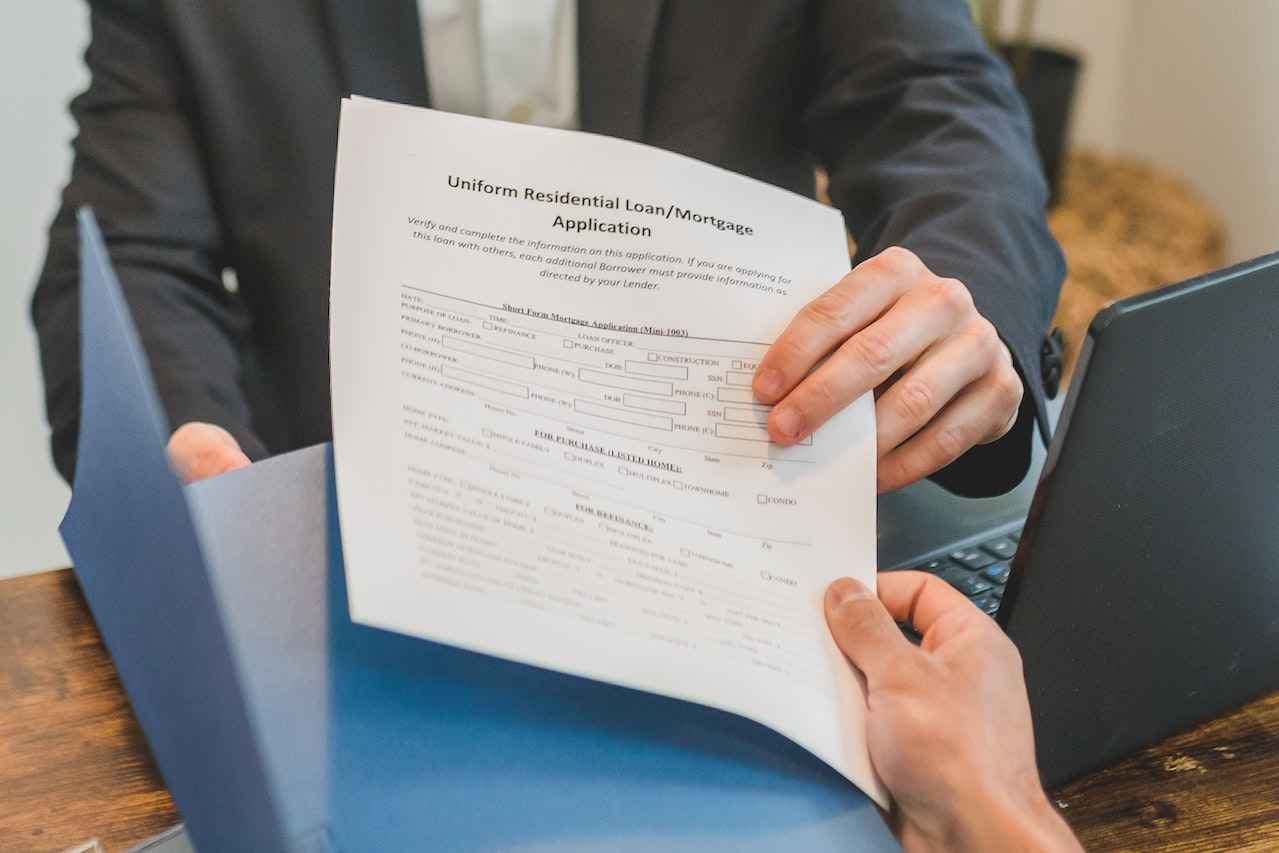

If you are self-employed in the United Kingdom, obtaining a mortgage might be more complicated than being a paid employee working for a company.

It is because most lenders look for evidence of a consistent income and a stable work history, which may require more work to demonstrate for self-employed people.

Despite this, it is still feasible to get a mortgage even if you are self-employed, and there are a few things you can do to boost the likelihood that the lender will accept your application.

We will provide detailed information on how to get a mortgage in the UK.

How To Get A Mortgage In UK When You Are A Self Employed?

#1. Gather all of your financial documents

- Lenders will want proof of your income, such as your tax returns, profit and loss statements, and bank statements.

- Make sure you have these documents ready to present to the lender.

#2. Have a good credit score

- A good credit score will make you more likely to be approved for a mortgage.

- Make sure to check your credit score and work on improving it if necessary before you apply for a mortgage.

#3. Find a lender that is willing to work with self-employed individuals.

- Not all lenders are willing to work with self-employed individuals, so it is essential to find one that is.

- You can ask your bank or mortgage broker if they have experience working with self-employed individuals.

#4. Have a large deposit

- A considerable deposit will make you more likely to be approved for a mortgage.

- The larger the deposit, the smaller the loan you will need, decreasing the risk for the lender.

#5. Be prepared to provide additional documentation.

- Self-employed individuals may need additional documentation, such as a business plan or financial projections, to prove their income and stability.

#6. Be flexible with the type of mortgage you choose

- Self-employed individuals may have a more challenging time qualifying for a traditional mortgage, so they may need to consider alternative options such as an interest-only mortgage or a guarantor mortgage.

#7. Consider getting a mortgage broker.

- A mortgage broker can help you find a lender willing to work with self-employed individuals and guide you through the mortgage application process.

How to Find the Best Self-Employed Mortgage in the UK?

#1. Research different lenders

- Not all lenders have the exact requirements for self-employed individuals, so it’s essential to research different options to find the best fit for you.

- Look into each lender’s interest rates, fees, and other terms.

#2. Consider using a mortgage broker.

- A mortgage broker can help you find a lender willing to work with self-employed individuals and guide you through the mortgage application process.

- They can also help you find the best mortgage rates and deals available.

#3. Check your credit score.

- A good credit score will make you more likely to be approved for a mortgage and help you get a lower interest rate.

- Make sure to check your credit score and work on improving it if necessary before you apply for a mortgage.

#4. Provide accurate and complete financial documentation

- Lenders will want proof of your income, such as your tax returns, profit and loss statements, and bank statements.

- Make sure you have these documents ready to present to the lender.

- Be prepared to provide additional documentation.

- Self-employed individuals may need additional documentation, such as a business plan or financial projections, to prove their income and stability.

#5. Be flexible with the type of mortgage you choose

- Self-employed individuals may have a more challenging time qualifying for a traditional mortgage, so they may need to consider alternative options such as an interest-only mortgage or a guarantor mortgage.

- Compare rates and fees.

- Compare each lender’s interest rates and fees to find the best deal.

- Also, consider checking online comparison tools and lenders’ websites to compare the rates and fees.

#6. Read the fine print

- Before signing any agreement, ensure you understand all the terms and conditions of the mortgage.

- Read the fine print carefully and ask the lender to explain anything you need help understanding.

Can You Get A Mortgage If You’re Self-employed?

Yes, you can receive a mortgage if you are self-employed. The procedure, however, may be more complex than if you were a paid employee. Lenders may want a higher credit score, a bigger deposit, and more proof to verify income and stability for self-employed persons.

Furthermore, self-employed persons may need help qualifying for a typical mortgage and may need to explore alternatives such as an interest-only mortgage or a guarantor mortgage. It’s also worth noting that some lenders now look at typical income over time rather than the most recent year.

This might be advantageous for self-employed borrowers with unpredictable incomes. It’s usually a good idea to check with your lender to see whether they have this policy.

Advantages of Self-Employed Mortgages

Might make use of projections

Although you may be required to produce further documentation about your wages, specific lenders may consider the possibility of lending money based on your anticipated revenue.

Because lending decisions for people who are paid through PAYE will be made solely based on their current salary at the time of application, having a lender consider what your income might be in the future could significantly impact the total amount you are permitted to borrow.

Underwriters

Because it is thought to be more challenging to evaluate papers related to self-employment, such as business accounts, Several mortgage lenders employ underwriters who have received specialized training to deal only with processing these particular kinds of mortgage applications.

This will give you a more personalized and customized approach to evaluating your loan since they will have a broader understanding of how companies operate and manage accounts.

Flexible company directors

When it comes to income, many lenders can use one of two approaches when evaluating directors of limited companies. This will occur either via the payment of salary and dividends or through the payment of salary and net profit.

Since of this, a lender has much more room for manoeuvrability when considering your application because it gives them two maximum loan amounts to choose from.

Using a mortgage calculator that accounts for self-employment might be an excellent method to gauge the potential impact this shift could have on your finances.

Same rates and choices as PAYE applicants

Even though it is not technically an advantage, self-employed people do not have any disadvantages when it comes to the mortgages that are accessible to them.

They are eligible for the same rates and packages. The primary distinction is in how the lender evaluates the application.

Self-employed people also have a greater chance of being accepted for housing assistance programs offered by the government or private lenders.

These programs include shared ownership, the right to purchase and the deposit unlock plan.

Disadvantages of Self-Employed Mortgages

Extra papers necessary

When you are self-employed, the income utilized to evaluate your eligibility for a loan is usually that which has been presented for the two years before. As a result, you will probably be required to give your tax returns and accounts for the most recent two years. You can even be requested to provide company bank statements and your financial records.

Even though borrowers are required to supply additional documentation, lenders strive to reduce the amount of paperwork they seek to a minimum by asking for what they consider essential. Being well-organized and maintaining accurate records may both lead to fruitful outcomes.

Lenders and underwriters need more comprehension.

It is tough to comprehend this industry if one is not already familiar with the organizational frameworks and terminology used in freelancing.

When things are more understood, it may result in understanding, leading to a loan being rejected. Since many lenders are geared up to operate on volume and with speed, this can lead to a loan being declined.

Variable income

Payslips may be used to confirm that an individual on PAYE receives a predetermined salary, which is the case in most cases.

The revenue that one receives from working for oneself is more complex since it may and does fluctuate from year to year based on various factors, including, on occasion, unique occurrences. The effect that Covid had is a perfect illustration of this.

Improved credit scoring

A credit rating system will often be used when an individual applies for a loan or mortgage. Many of them are automated and centred on a point scoring system, which means that to be accepted, you need to get a certain minimum amount of points, often known as a score.

Although lenders do not reveal the details of what information receives what quantity of points, it is commonly believed that having a self-employed income status results in a lower score than having an employment income status.

FAQ-

How many mortgages Can I Get?

The mortgage you may acquire in the UK is determined by criteria such as your salary, credit score, and deposit size. Lenders will often grant mortgages up to 4-5 times the borrower’s salary, however, this varies based on the lender and the kind of mortgage.

How To Get A Mortgage With Bad Credit?

Obtaining a mortgage with bad credit might be difficult, but it is possible. Finding a co-signer, improving your credit score, and looking for lenders specializing in poor credit mortgages are all possibilities to explore.

What Stops You from Getting A Mortgage?

Some factors that can prevent an individual from obtaining a mortgage include a low credit score, insufficient income, a high debt-to-income ratio, and a substantial down payment.

How To Get A Mortgage With No Deposit?

It is possible to get a mortgage with no deposit in the UK, but it may be more challenging and will likely require a guarantor or a higher interest rate.

Alternative options, such as shared ownership or government-backed schemes, are available.

How To Get A Mortgage First-time Buyer?

To get a mortgage as a first-time buyer in the UK, it’s essential to have a good credit score, save for a deposit, and show proof of income.

Additionally, researching different lenders, comparing rates and fees, and consulting with a mortgage broker if necessary can help increase the chances of finding the best mortgage deal.

Conclusion

Getting a mortgage as a self-employed individual in the UK can be more challenging than if you were a salaried employee.

However, it is still possible to get a mortgage if you are self-employed.

By gathering all of your financial documents, having a good credit score, finding a lender that is willing to work with self-employed individuals, having a large deposit, being prepared to provide additional documentation, being flexible with the type of mortgage you choose, and considering a mortgage broker, you can increase your chances of being approved for a mortgage.

I hope you understand how to get a mortgage in the UK. If you have queries regarding it, ask them in the comment section.