Are you looking for the best investing apps for beginners? It is now possible to manage all of your investments on the go using effective investment apps.

That means you can keep your eyes on your investments all the time. Luckily, there is no shortage of investment apps that are also user-friendly in the UK. New investors can use such apps to build, grow, and diversify their portfolios.

In this article, we are going to provide a list of the 10 best investing apps UK to help you reach your financial goals. Check out our below list!

Understanding the UK Investment:

The United Kingdom has a consistent, and high-spending consumer market, an open liberal economy, a business-friendly regulatory environment, and world-class talent.

The language, legal system, time zone, funding environment, and lack of red tape help the UK investment market tend to be one of the easiest markets to build, scale, and grow a business.

The United Kingdom with a population of 67 million people and with a GDP of $3.2 trillion is a major international trading zone. It is the fifth largest economy in the entire world according to the World Bank. Investors in the UK have various options to invest ranging from low-risk bonds to high-risk equity shares.

Investors who are looking for income, growth, or both have various options to access.

Some of the UK investments include Individual Savings Accounts (ISAs), Junior ISAs (JISA), Cash ISA, Lifetime ISA (LISAs), Innovative Finance ISA (IFISA), and Other savings accounts.

Various investment products of the United Kingdom include Shares, Stocks, Bonds, Real Estate Investment Trusts( REITs), Investment funds, Exchange-traded funds, cryptocurrencies, and more.

Investors can also invest in Other Savings accounts investments that include Fixed-Interest Savings Accounts, Self-Invested Personal Pensions, and more.

according to the previous history, shares in the stock market offered higher returns compared with other investment classes.

However, if you are looking for UK investments that can return you a higher monthly income then there are various options to consider. Also, you should make the decision according to your personal circumstances as well

Understanding Investing Apps:

What is an Investing App?

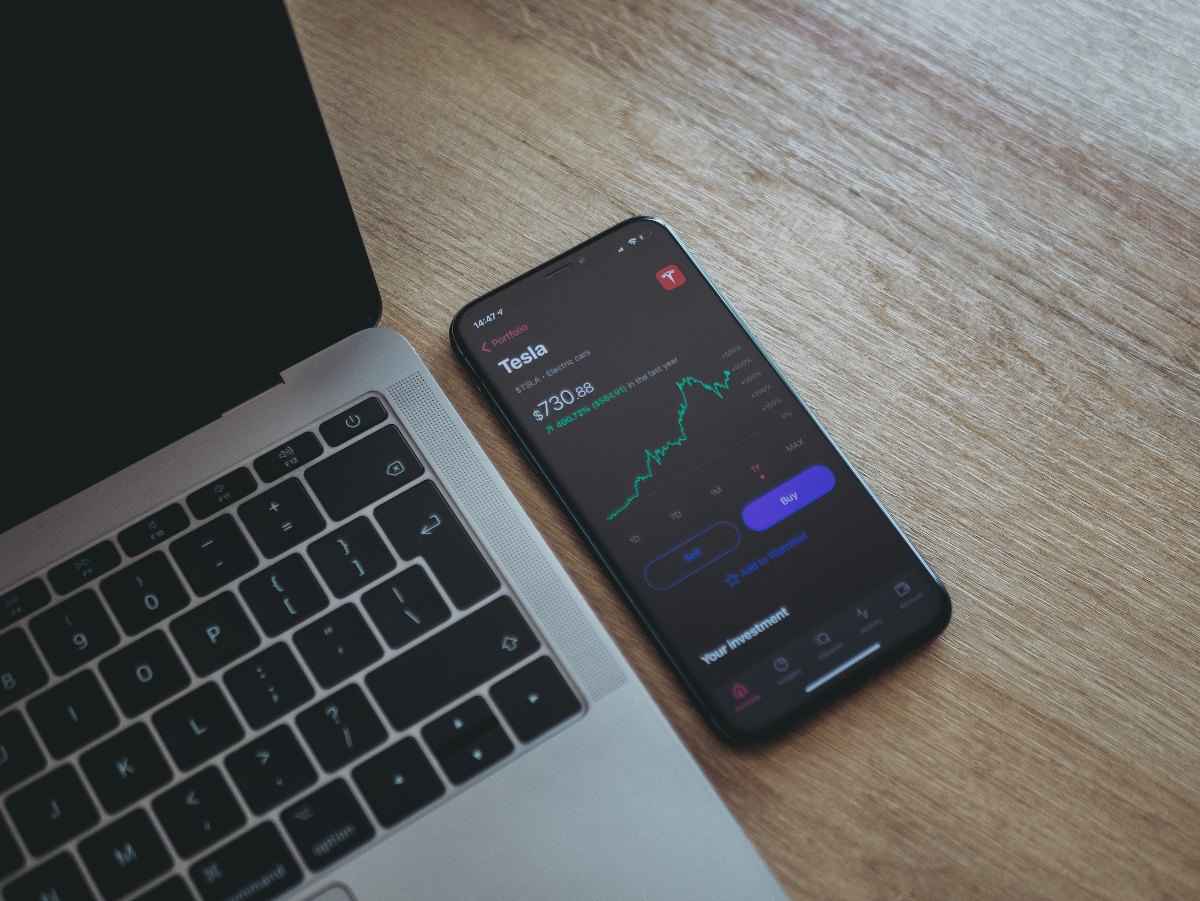

An investing app is a program that you can access from your mobile phone that allows you to invest and manage your money in different financial markets.

These different financial markets include mutual funds, stocks, bonds, and cryptocurrencies.

these investing apps offer the user a convenient way to manage investments, track their portfolio, and make an informed investment decision.

These investing apps come with a range of features that include investment research tools, quotes, news, analysis, customizable portfolios, and trading capabilities. Some apps also come with automated investing features that include robo-advisor services.

Investing apps are very useful tools for both beginners and experienced investors. These apps offer easier access to the UK financial market and a range of investment categories. But, you must be aware of the associated risks and fees of the investing apps out into the market.

How do Investing apps work?

Whether you are installing an investing app on your mobile you can check the share market live using this investing app. The share market live view helps you in many ways to trade various marketplaces.

Here, we are providing some key functions that any potential investment app can perform and thereby aim to reach the financial goal.

- Monitors a user’s investments and corresponding financial portfolio

- Investors can open a Demat account with the investment apps

- Investors can invest in a wide range of assets including stocks, commodities, mutual funds, and more using the investment apps.

- Investors can perform stock trading through investment apps

- The investment apps provide a view of the stock market today to investors. Also, they offer a view of any relevant market where the investors can invest.

Types of Investment Options available:

Here, we are providing a brief description of the most popular investment options available in the market UK:

1. Stocks and Shares ISAs:

A Stocks and shares ISA is a type of Individual Savings Account that holds investments such as shares of stocks, mutual funds, bonds, or exchange-traded funds.

A tax-free way to invest in shares or investment funds, and you can invest up to an annual limit currently 20,000 Pounds for 2023-24.

It works as a regulator investment account but avails tax-free returns. If you are looking for long-term investment then you can consider stocks and Shares ISAs, Also you can consider this investment product a way of growing your wealth.

These investment products are of higher risks but also provide higher returns than cash ISAs because they depend on the performance of the underlying investments.

2. Bonds and Gilts:

Actually, a bond is a type of loan made by an investor to a borrower, it can be corporate or governmental. As an investor when you purchase a bond the issuer of the bond borrows money from yo

You are lending money to the issuer of the bond. You will enjoy periodic interest payments and the return of the bond’s face value when it matures.

If you invest in UK bonds then you can earn a predictable income and also a bond is considered a less-risk investment product than stocks.

But, you must keep in mind that these investment products are not risk-free. These bonds come with credit risk, interest risk, and more.

3. Mutual Funds:

A mutual fund is another investment product that allows you to invest your money into a pool of capital together with other investors for purchasing stocks, bonds, and other securities in a portfolio. The value of a mutual fund is also known as the net asset value.

Investors can earn returns from mutual funds in three different ways such as dividends, individual sales, and fund sales.

Different types of mutual funds are equity funds, fixed-income funds, index funds, balanced funds, income funds, international or global funds, money market funds, special funds, and more.

4. ETFs (Exchange Traded Funds):

ETFs are investment fund shares that are traded on stock exchanges. ETFs are able to track a range of indexes, from broad market indexes to specific sectors, geographical regions, or even commodities.

They offer a diverse and cost-effective way to access a wide range of assets, with the added benefit of liquidity. You can buy or sell shares in the ETFs throughout the trading day at the market price.

Benefits of Using Investing Apps:

If you have an interest in money making then you can consider effective investment apps. Here are some of the benefits:

1. Simple to use:

In the past, when you call an agent to open an account, the scene is very different nowadays. You can set up your account in a minute and also you can track all of your investments progress and review your options.

Investing in apps is beneficial because most of them are automatic. Investing apps are smarter enough to automatically limit your investing amount. Also, when you invest, you can have automatic savings offered by the investing apps.

2. Low to No Fees:

Previously, trading stocks and other financial tools that the investors use online demands a commission. But, these investing apps do not charge any money to trade stocks or ETFs. However, some apps may charge a fee for option contracts.

3. Easy access to Resources:

While the options and features can vary from app to app, mobile brokers offer you resources from where you can gather more knowledge of investing. You can also learn about how to develop a good strategy, and other crucial concepts.

These investing apps provide you with real-time information and some relevant news regarding stocks and companies. Thus you can make an informed trading decision.

4. Low Barrier to Entry:

Some brokers still ask you to open an account with a minimum deposit, but these mobile investing apps allow you to open an account with no minimum deposit at all.

Various mobile investing apps allow you to purchase fractional shares, then you may be able to invest in an individual stock with a minimal amount.

Criteria for Choosing the Best Investing Apps:

To determine which mobile investing app will work best for you, you need to first figure out your financial goals and how much you can invest. Also, you should compare the features offered by different stock trading platforms and the features that you require.

Here, we are providing some of the factors that you should consider while picking the right investing apps for your finances:

1. Fees:

Most of the investing apps are micro-investing sites that allow the investor with no commission or very low management fees.

These investing apps help you to grow your money even more as fees can consume your earnings over time. Various micro-investing apps also require a no minimum or very low account balance.

Micro-investing apps help investors start their investing with a little money saved.

There are various investing sites that require a larger sum to have in their account to start investing. Also, they charge commissions and management fees.

So, while choosing the investing app, you must look for the minimum account balances that are mandatory for them.

2. Platform:

Various mobile investing apps are compatible with iOS and Android platforms for online stock trading together.

Some of the apps are designed in such a way that you can start trading with a single click. various apps are also compatible with Desktop platforms.

The platforms of investing apps also offer various investment-related blogs that help you gather more knowledge about investing. The platforms of the apps help the investors to invest 0online using their mobile.

3. Tools:

When you invest your money online using an investing app you can access a range of array of tools. Some investing apps come with a broad variety of tools that allow you to manage your personal budgeting.

these tools may send alert notifications to your mobile phone regarding market prices.

These apps help you to trade anywhere and to stay connected in real-time to your investment portfolio from anywhere you can access the internet.

Many of the investing apps support the investors with charts researched reports, and automatic deposits from linked funding accounts.

4. Advisory services:

The advisory services that are available with different investing apps can vary. Most of the apps offer the investors access to the customer support charts, thus investors can get information on how to invest with these investing apps.

Most of the apps use robo-advisors to provide advice according to the algorithms.

other investing apps offer limited customer phone consultations for qualified individuals. These apps also offer limited consultation with online investment brokers through high-tired plans.

10 Best Investing Apps for Beginners in the UK:

1. Moneybox:

Moneybox is a UK investing app that allows you to invest in a wide range of tracker funds, exchange-traded-commodities (ETCs), exchange-traded funds (ETFs), and US stocks.

This app offers two forms of investing depending on the investor’s investing savviness, investing strategy, and potentiality to handle the risk factors.

This app is very effective for beginners, and it offers commission-free trading on US stocks.

features:

- financial goal tracker

- track your progress

- initial balance setting

- You can start your moneybox app with the existing balance to reflect your real-time savings

- Flexibility in money management

- Deposit or withdraw cash easily

- Invest from 1 Pound

- Invest your spare change using the ’round up’ function.

2. XTB:

If you are looking for the best UK investing app for UK stock trading then you can consider XTB. With over two decades of experience, this investing app offers a comprehensive trading experience.

It is a renowned CFD broker and boasts impressively very low trading fees. It will be a great pick over 2100 tradable instruments. It also acts as an educational suite that caters to all trader levels.

If you are thinking to kick your investing then you can consider this app because it is easier to access.

Features:

- 0% commission on all supported markets

- Trade stocks, commodities, cryptocurrencies, ETFs, Forex, and indices

- One of the best high-leverage brokers

- A highly advanced trading suit that comes with analysis tools.

3. eToro:

This is one of the best investment platforms in the UK that will be great to use to learn how to trade. It offers a Demo account where you can use 100,000 Pounds as fake money so that you can feel how things work.

One of the distinct features of eToro is that it allows you to copy other traders who are successful.

These successful traders have a proven track record and you can automate everything so that you can trade just like them. It is one of the beginner-friendly investment apps in the UK.

Features:

- Investment from 0 Pounds

- Invest in cryptocurrencies or stocks

- Free investment insurance

- Replicate other investors with the CopyTrader feature

- FCA regulated

- You can create dummy trades with a practice account by creating a virtual portfolio

4. Wealthify:

Wealthify is another effective investing app that offers robo-advisors. These robo-advisors invest your money on behalf of you. On this platform, there are diversified portfolios available, so it is a great way to reduce any risk that you are exposed to.

You do not require any subscription fee on this platform. However, there is a 0.6% annual handling fee that will be paid to Wealthify.

Features:

- Invest from 1 Pound

- invest in a stocks and Shares ISA, Pension, junior ISAs, and General Investment Account

- FCA registered

- Your money is protected by FSCS.

- You can withdraw money from ISA and GIA accounts without any penalty

5. Plum:

Plum is another great investing app that opens up investing to everyone. It initiates the use of artificial intelligence to help you analyze your spending.

Also, it lets you know how much you can afford to invest in savings. Then this app automatically deducts this amount from your account each month.

plum has three levels of accounts where you can invest. The cheapest one will cost 1 Pound per month.

However, there are some handling fees that come with the app that are charged annually. With Plum, you can select to invest in a General Investment Account, or you can see the benefits of tax-free allowances with Stocks and Shares ISAs.

Features:

- Invest from 1 Pound

- You can get 5 Pound cashback with an active Plum account

- Invest with an ISA, Pension, or a General Investment Account

- Invest in ethical companies, tech, and emerging markets

- authorized and regulated by FCA

- Select between a list of funds with varying risk levels

6. Freetrade:

Free Trade is one of the best investing apps for beginners in the UK, it opens up trading to everyone. If you opt for its basic services then it comes free of cost.

It allows you to trade in the US and the UK stocks. There are initial public offers as well as special-purpose acquisition companies.

The great aspect of this platform is the community aspect. You can chat, and communicate with other users online and get some ideas on how the other investors are investing.

Features:

- No fees for basic investing accounts

- FSCS protection

- Buy US, UK, and European ETFs, and Stocks

- Authorized and regulated by FCA

- Invest in Stocks and shares ISAs, GIA, or SIPP

7. Trading 212:

Trading 212 is another best investing apps UK that benefits you with a free share by getting family, friends, and colleagues, to sign up.

It comes with unlimited commission-free trades and there are more than 10,000 stocks and ETFs to pick from. These investment products are in the US, UK, Netherlands, Spain, and Germany.

This app also offers contracts for differences. These are very riskier elements even professional investors are more likely to lose their money than gain.

But, you should not think that as a beginner, you should not touch these products. You can go forward because Trading 212 has this on offer.

Feature:

- Free Trading

- large choice of assets

- FSCS protection

- Useful video guides

- Authorized and Regulated by FCA

- Purchase US and UK stocks and EFTs

8. Moneyfarm:

Moneyfarm is a new platform of investing apps that offers robo-advisor services. However, the initial deposit is higher than the other apps.

If you are serious about investing then you can go forward with Moneyfarm. This investing app provides investment products and advises investors through a complete set of algorithms that are uniquely tailored for each individual investor.

They have a range of portfolios to suit every individual and this will be established through a financial questionnaire while you set up your account.

Features:

- ISAs and Personal Pensions available

- Minimum deposit of 500 pounds

- Annual app fee: 0.75%-0.35%

9. IG:

You can find more than 5,000 ETFs (Exchange-Traded-Funds) that you can invest in. IG is a great provider to pick if you are a beginner in this investment pavement.

This platform will help you to gather more knowledge from different angles. You will have a demo account and it is less riskier as you will use virtual money. But this demo account will perform exactly in the same way as the real one.

IG is an all-rounder platform, here you can invest in ISA, General investment account (GIA), and SIPP. If you are a beginner then don’t look further than this app since they have ready-made portfolios. They have some additional investment types for experienced investors also.

Features:

- Great learning resources

- Demo account

- Fee discounts for active investors

- provide more than 13,000 investments

- ready-made portfolio

10. InvestEngine:

InvestEngine is a relatively new investment platform that quickly catches the attention of investors. It comes with very low fees and you can use this investing app to create a DIY portfolio.

It offers a robo-advisor service. The app is designed in a way that anyone can access it. It is highly rated in the Google Play store as well.

on this platform, you can top up and manage your investing account and you can go forward to to monitor the breakdown

Features:

- You can get a ready-made portfolio or can build your own portfolio

- No extra costs are required for a Stocks and Shares ISA

- The DIY option is a great option to invest

- It is easy to use

- The platform looks great

- Low charges compared to other investing apps

FAQ:

What is the minimum investment required?

Ans: A minimum investment is the minimum share quantity that an investor can purchase when investing in a fund, special security, or opportunity.

For example, a mutual fund may require at least 500 Pounds for some type of fund, also it can be 50,000 pounds for another type of fund.

Can I use multiple Investing apps simultaneously?

Ans: Yes, you can utilize multiple investing apps at once. many stock trading apps are designed to be used simultaneously which allows you to track several portfolios, diversify your assets, and more. You can also enjoy the benefits of the special features that different apps come with.

What happens if the app goes down during a trade?

Ans: If the investing apps shut down then you will lose the ability to buy and sell stocks. So, your portfolio will remain the same until you get back online. Again, while you are one you can start trading through the investing apps.

Conclusion:

Whether you are a beginner or an experienced investor when it comes to investment, it is never been easier.

However, because of the advancement of modern technology, you can easily get started with one of the best investing apps out in the market. You can manage all of your investments from the palm of your hand.

Here, in this guide, we have covered every aspect of potential investing apps, so you can gather more knowledge from this article.

You can also choose one or more investing apps that seem to be relevant from our pick. Get the right sophisticated investing app now and manage and monitor your investments to reach your financial goal!