P2P lending, also known as peer-to-peer lending, has been practised in the UK for the last 15 years in its present iteration. By providing a platform on which individuals may lend to (and borrow from) one another directly.

It is intended to eliminate the need for a third party to mediate the relationship between savers and borrowers (or semi-directly). But how secure is borrowing from strangers? How much could you get, how much could you lose, and what is the likelihood that you will not receive your money back?

Please continue reading to learn more about peer-to-peer lending, its advantages and disadvantages, and other information.

What Is Peer-to-Peer Lending?

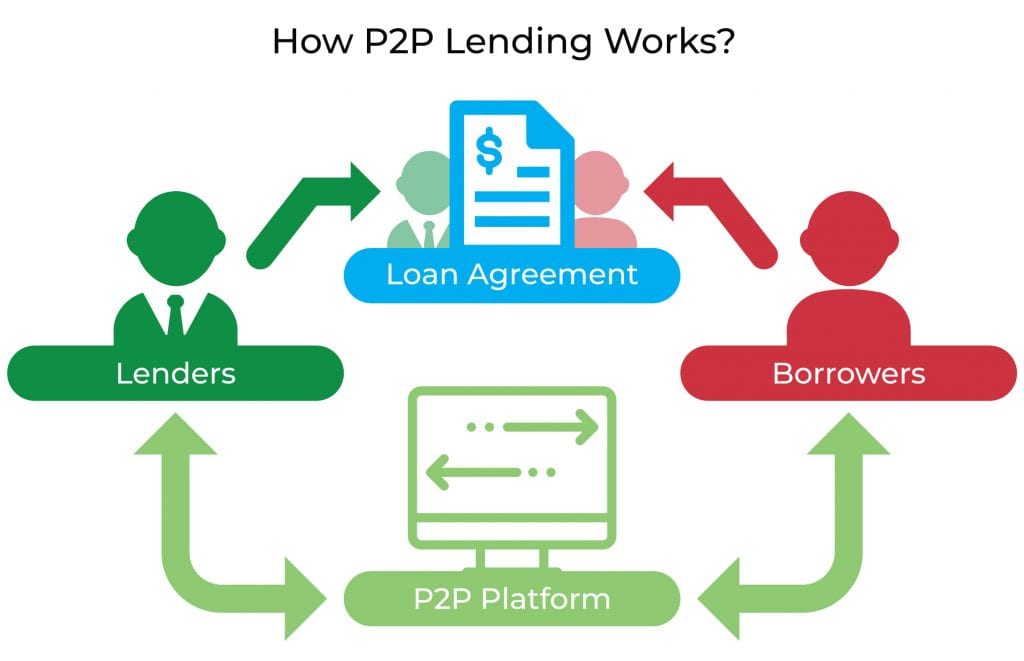

Peer To Peer Lending is a debt financing that eliminates the need for people to go through an intermediate institution like a bank to borrow or lend money to one another. To put it another way, it’s a platform that enables individuals to lend and borrow money directly from one another.

This alternative method of financing for businesses has been present since approximately 2005. It has been gaining in popularity since it provides borrowers with a variety of benefits in comparison to standard bank loans. Peer-to-peer networks are used by businesses to help finance projects at rates that are more appealing to investors.

How Does Peer-to-Peer Lending Work?

Websites that facilitate peer-to-peer lending bring together borrowers and lenders. If you need to borrow money, you have two options: either you may submit your needs directly to one of the numerous P2P sites that are located in the UK, or you can use a peer-to-peer loan comparison website, which will search the market to find you the best offer possible.

Your application for a loan will be evaluated in the same manner as one submitted to a conventional financial institution. The peer-to-peer loan platform will utilise a credit reference bureau to sift through information accessible to the public, such as the electoral register.

It will analyse your financial history to determine your credit rating, also known as the level of risk associated with lending to you. If your loan request is approved, the system will attempt to pair you with other borrowers interested in providing you with a peer-to-peer loan.

If you are interested in investing or becoming a lender, establish an account on the website that facilitates peer-to-peer lending. Then, transfer the funds you wish to use for investing into that account. You can choose the rate of return you are interested in earning and distribute your funds across several borrowers, lowering the probability that a loan will not be returned. On certain websites, you can even place bids on available loans.

However, since each platform operates uniquely and provides investors with varying degrees of security, you must do enough research to choose the solution that best meets your needs. In general, the return rate offered to investors is expected to be lower when the investment is seen as having a higher level of safety.

Advantages Of Peer-to-Peer Lending

Interest Rates

The interest rates offered are the primary selling point for many peer-to-peer lending platforms. The low-interest rates offered by conventional savings accounts push many individuals to investigate alternative methods to make the most of their money, including peer-to-peer (P2P) investments. This is even though the two products cannot be compared.

Easy of Use

Compared to other investments, such as equities and shares, many individuals who invest find that peer-to-peer (P2P) platforms are comparatively simple to use. You won’t need any prior experience in finance to get started with them since they are often conducted online and use just a minimal amount of industry terminology.

Peer-to-peer also tends to provide modest minimum investment levels, which might give you an excellent chance to “dip your toe in the water” if you are still relatively new to investing. Peer-to-peer also tends to have fewer restrictions on who can invest.

Diversification

Because you are investing only some of your money into a single loan, most peer-to-peer platforms will have at least one product that automatically diversifies (spreads) your investment over many possibilities.

Variation

With the flexibility that comes with peer-to-peer lending, investors have many options when deciding how to put their money to work. Some popular applications include small company finance, assisting customers in expanding their real estate holdings, and supporting new home projects.

Secondary Market

Investors can sell portions of their loans to other investors via secondary markets, even though it is never safe to anticipate that they will have an early exit from their investment. This gives you access to liquidity if your circumstances change and you need to access your money sooner than you had expected.

Disadvantages Of Peer To Peer Lending

Capital Is At Risk

Financial Services Compensation Scheme does not protect investments made via peer-to-peer platforms, you may lose the amount you initially invested. Although media take precautions to prevent this from occurring, there is no assurance that it will; in most cases, the return of your principal plus interest is contingent on the borrower making their payments. Before you lend any money via a peer-to-peer network, you should always ensure you completely understand the dangers involved.

Platform Variety

The phrase “peer-to-peer lending” refers to various platforms, types of loans, and different kinds of assets. Before deciding to invest, you must thoroughly examine each option and research in a way that is particular to the opportunity. Even though past performance may be a more reliable indicator of future success, it is still a good idea to investigate who is operating the platform, their professional backgrounds, and how their loans have historically been managed.

Checking out who is using the platform, their professional backgrounds, and how their loans have historically fared. If you do not have any family members or friends who are already investing with the platform of your choice, another fantastic way to hear customer feedback is to look at internet review sites such as Trustpilot.

Tax Responsibilities

The rules for paying tax on the interest you earn from your peer-to-peer investments are set by HMRC, and you must ensure that you comply with those requirements. Any money you make via peer-to-peer lending may count toward your annual personal savings allowance.

It is currently set at £1,000 for taxpayers who pay the introductory rate of taxation and £500 for those who pay a higher rate of taxation. It implies that you won’t have to pay tax on interest up to this amount as long as you meet the requirements.

Is Peer To Peer Lending Safe?

A savings account differs from peer-to-peer lending, which poses a more significant risk for the borrower. When you place your funds in a savings account at a financial institution such as a bank or building society, you can earn a rate of interest in return while exposing your capital to minimal risk. However, conventional lenders’ rates of return on savings are low.

The FSCS Scheme covers up to £85,000 per account if you keep it in a licenced bank or building society. If the bank failed, the government would step in to reimburse you, and your cash would be safeguarded. This is not the case with financing done between individuals directly. It does not fall under the FSCS’s protection.

Is Peer To Peer Lending Worth Considering?

P2P lending is far riskier than keeping money in a traditional savings account. Therefore you should only invest money that you can afford to lose in this kind of investment. Even in that case, the future is so uncertain that engaging in this kind of loan entails an unacceptable risk in the near term.

On the other hand, peer-to-peer lending offers a substantially higher rate of interest, which is one of the reasons why some lenders find it appealing. The websites that provide peer-to-peer lending link lenders and borrowers at more excellent interest rates than those offered by banks, but the websites take a fee for their work arranging the transaction.

Conclusion

As with all other financial choices, the appropriate response will depend on you, your circumstances, and your willingness to take risks. The advantages of peer-to-peer lending are many, and it’s often an efficient method to either diversify your portfolio or get your foot in the door of the investment world if you’re looking for something to which you don’t need to commit a significant amount of time or money to get started.

However, you must look beyond the interest rates offered and comprehend the hazards; eventually, the return on your investment may be delayed, and you may lose all or part of the money you invested. You must consult an expert if you have any inquiries about peer-to-peer lending or how things operate.